Payroll tip calculator

It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Ad Compare This Years Top 5 Free Payroll Software.

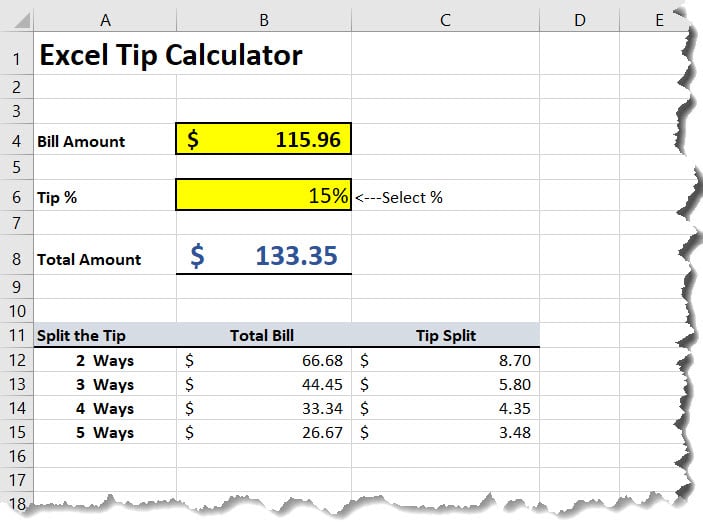

Tip Calculator Template In Excel Download Template Excelbuddy Com

All Services Backed by Tax Guarantee.

. It will confirm the deductions you include on your. Ad Process Payroll Faster Easier With ADP Payroll. It should not be.

Small Business Low-Priced Payroll Service. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Plug in the amount of money youd like to take home.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Ad Payroll So Easy You Can Set It Up Run It Yourself. Get Started With ADP Payroll.

Withhold 62 of each employees taxable wages until they earn gross pay. For our calculations assuming the gratuity has already been received by the. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Supports hourly salary income and multiple pay frequencies. How to calculate annual income. Ad Process Payroll Faster Easier With ADP Payroll.

Whether its W-4 deductions gross-up. This free easy to use payroll calculator will calculate your take home pay. The Shared Bill Tip Calculator considers the cost of the service number of people and chosen tip percentage to calculate the tip per person as well as the total cost per person.

Important Information The calculator that is provided on this web site is only meant to provide general guidance and estimates about the payroll process. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Home Calculators Tip Tax Calculator.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. And as long as they earn more than 20 in tips a month you are required to take out withholding taxes.

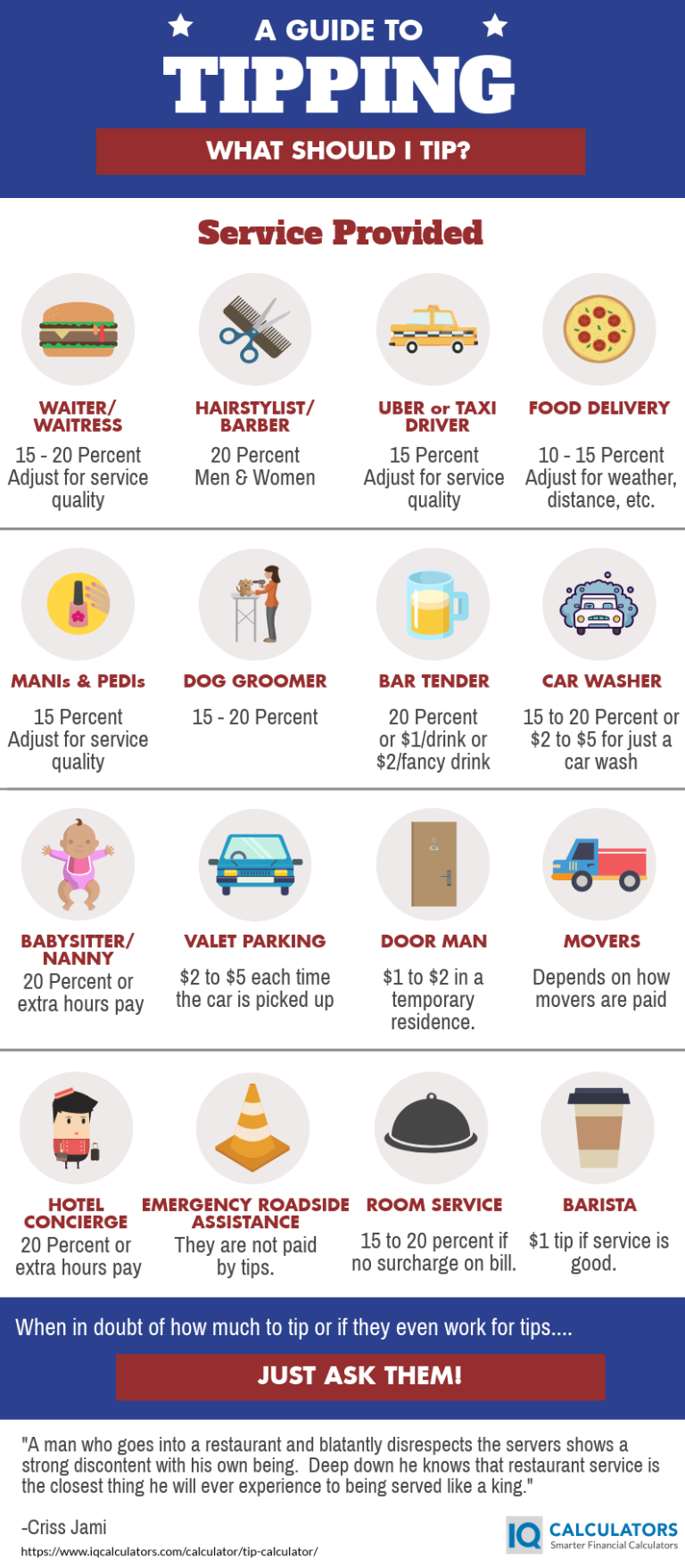

The Ahola Corporation 6820 West Snowville Rd. Free Unbiased Reviews Top Picks. Tip Calculator The Tip Calculator calculates tip amount for various percentages of the cost of the service and also provides a total amount that.

Starting as Low as 6Month. Subtract any deductions and. There are fail-safe mechanisms in place in every state that protect the.

Brecksville Ohio 44141 8007272849. Heres a step-by-step guide to walk. Ad Compare This Years Top 5 Free Payroll Software.

Get Started With ADP Payroll. For example if an employee earns. Get Started With ADP Payroll.

If youre looking to calculate payroll for an employee or yourself youve come to the right place. If calculating withholding taxes on tips sounds complicated to you dont worry. The Tax-Tip Calculator For those who receive tips here is an easy way to verify or anticipate your paycheck.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. 8 FREE payroll calculators for you and your employees. 3 Months Free Trial.

This number is the gross pay per pay period. Click the image above to check out our Texas Paystub Generator Texas has a maximum tip credit of 512hour. Free Unbiased Reviews Top Picks.

![]()

Tip Tax Calculator Payroll For Tipped Employees Onpay

Tip Calculator Free Tip Calculator App

Tip Tax Calculator Primepay

How To Calculate Payroll For Hourly Employees Sling

Tip Tax Calculator Payroll For Tipped Employees Onpay

How To Calculate Wages 14 Steps With Pictures Wikihow

Tip Calculator How To Calculate A Tip Wise

How To Calculate Payroll Taxes Methods Examples More

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Payroll Calculator With Pay Stubs For Excel

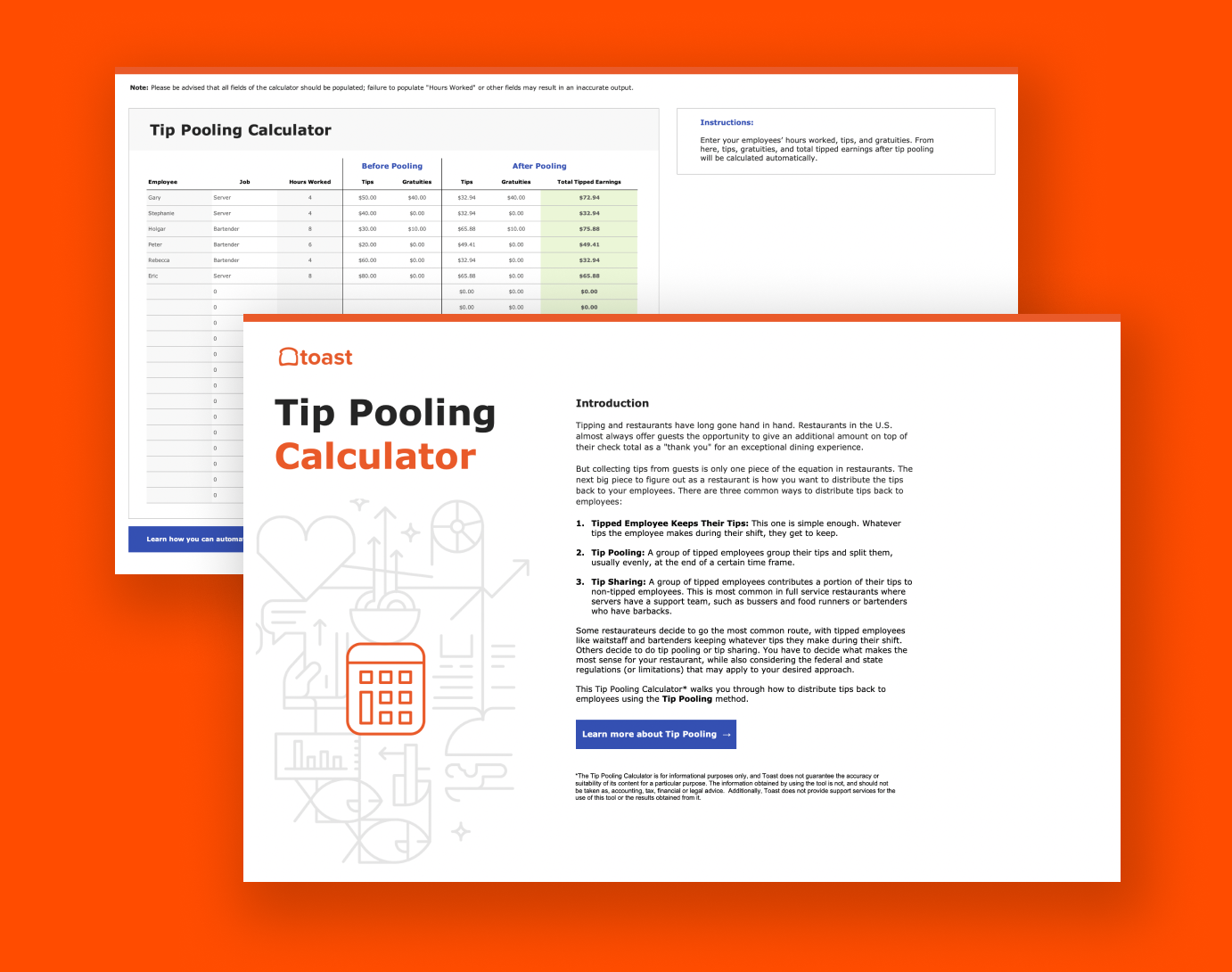

Tip Pooling Calculator Toast Pos

Nvai7b73uqmw5m

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

How To Calculate A Tip Without A Calculator

Tip Pooling Calculator Toast Pos

Free Tip Tax Calculator

Payroll Calculator For Excel Excel Tutorials Excel Templates Payroll